Discover Your Essential

Payroll Resource Hub

Explore Our Free Pension Guides

Managing pensions doesn’t have to be complicated. Whether you’re a small business owner or a payroll professional, understanding pensions is essential for ensuring compliance and supporting your team’s financial future. Our expertly crafted guides are here to simplify the process and provide you with the tools you need to succeed.

Please note: We are not pension advisors and will discuss administration of pensions via payroll only. We can not provide pension advice but can assist with an essential business administration process.

-

Our Brief Guide to Pensions:

This guide provides a concise yet thorough introduction to workplace pension schemes, covering essential topics like automatic enrolment, contribution rates, and the benefits of different types of pension arrangements. Perfect for small businesses, it simplifies complex regulations and equips you with the knowledge to support your employees' retirement savings effectively.

-

Tax Relief on Pensions:

Our comprehensive guide explains how pension tax relief operates in the UK, detailing both 'Relief at Source' and 'Net Pay Arrangements.' It offers actionable insights for ensuring compliance, maximizing savings, and helping employees make the most of their contributions. Ideal for small businesses looking to manage payroll efficiently while supporting their team's retirement planning

-

Payroll Compliance Checklist:

This guide is an essential tool for small businesses to ensure their payroll processes remain compliant with UK regulations. It covers critical areas such as auto-enrolment, accurate payroll record maintenance, and compliance with tax codes and National Insurance contributions. By following this checklist, businesses can avoid costly errors and streamline their payroll operations effectively.

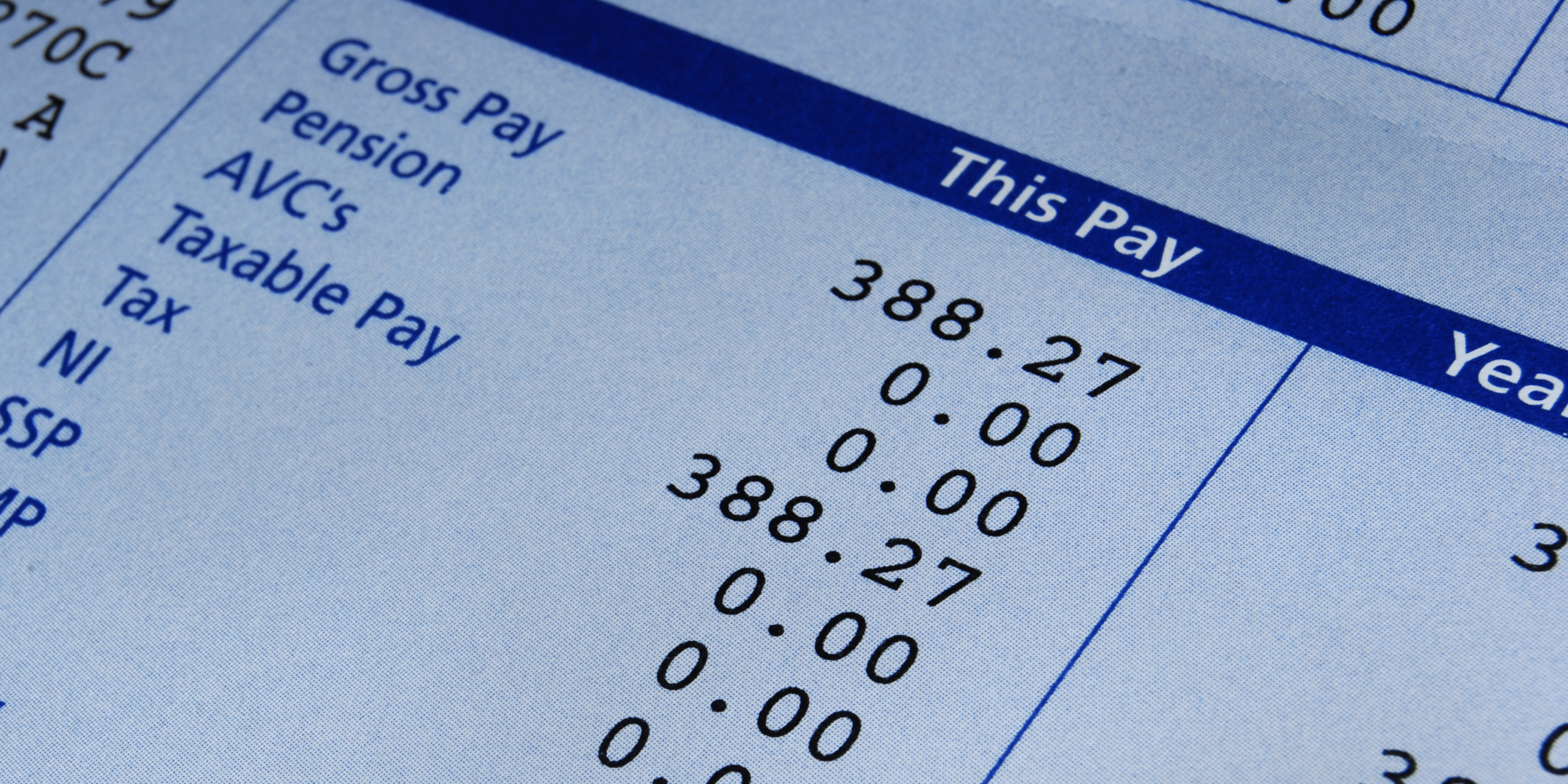

Payroll Glossary: Your Essential Guide to Payroll Terminology

Payroll can be filled with complex terms and industry jargon, making it challenging to navigate—especially when ensuring compliance with UK regulations. Whether you're an employer, HR professional, or just looking to understand payroll better, our Payroll Glossary provides clear, concise definitions of key terms you need to know.

From PAYE and RTI to auto-enrolment and statutory payments, our glossary covers everything to help you stay informed and compliant.